Crypto Credit Bureau

A credit scoring protocol providing risk assessment for unsecured crypto lending

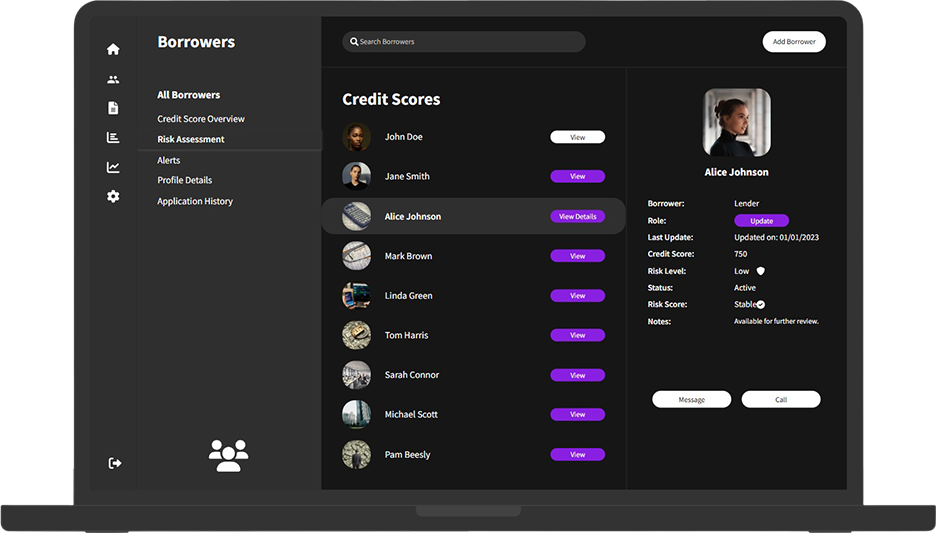

For Lenders

Gain deeper insights into borrower risk with our AI-powered credit history platform for unsecured crypto lending. We aggregate on-chain repayment behavior and off-chain social signals to provide a unified borrower profile — helping you identify creditworthy users even without collateral. Our risk scores are verifiable, privacy-preserving, and built for DeFi-native borrowers, enabling you to reduce defaults, increase capital efficiency, and unlock new lending opportunities in underbanked markets.

For Borrowers

Access fair and transparent credit without collateral. Our platform helps you build a portable credit profile by aggregating your on-chain repayment history and verified social signals — giving you the power to prove your trustworthiness to lenders across protocols. Whether you're borrowing for trading, business, or personal use, our system rewards responsible behavior with better rates, higher limits, and broader access to unsecured crypto loans. Your reputation travels with you — no paperwork, no gatekeepers.

The Process

Connect Wallet or Platform

Borrowers link their wallet or account; lenders get access to our scoring API or dashboard.

Credit Profile is Generated

We aggregate on-chain repayment data, usage across lending protocols, social verifications, and more into a unified risk profile.

Make Informed Lending Decisions / Apply for Credit

Lenders evaluate borrowers using our trust score; borrowers access offers based on their reputation — no collateral required.

Bringing Trust to Unsecured Crypto Lending

Our platform enables secure, data-driven lending in the crypto space by aggregating and verifying borrower creditworthiness — without relying on collateral. We combine on-chain repayment history, decentralized identity, and AI-analyzed social signals to build a comprehensive risk profile for each user. These profiles help lenders confidently extend unsecured loans while giving borrowers fairer access to capital.

Borrowers generate zero-knowledge proofs to demonstrate credit reliability without exposing private details, and their repayment activity is continuously monitored across major protocols. Verified identities using systems like World ID further strengthen the trust layer, while disputes over credit data are resolved transparently via decentralized arbitration through Kleros. This ensures data integrity and a fair lending environment for all participants.

Platform Features

Repayment History Ledger

We maintain a database of borrower repayment records across lending platforms.

Decentralized Identity

Borrowers can verify identity using World ID or other secure, privacy-preserving credentials.

Real-Time On-Chain Monitoring

Our system automatically tracks on-chain repayment behavior to keep credit profiles up to date.

AI Social Signal Analysis

We analyze borrower social profiles with AI to detect trust indicators and potential risks.

Dispute Resolution via Kleros

Credit report disputes are resolved transparently using Kleros decentralized arbitration.

Zero-Knowledge Proofs

Borrowers can generate ZK proofs to verify creditworthiness without revealing sensitive data.

See how it works — request a demo and explore the future of trust-based crypto lending.